Mortgage Calculators: How to Calculate Your Mortgage Payments

When you’re starting the home buying process, it’s easy to get caught up in house hunting without paying enough attention to the financial aspect. I’m often surprised by how many friends and family members are given a pre-approval price by a lender without figuring out what that looks like in terms of monthly payments.

Another scenario I frequently hear is from people who shop by house payment based solely on the monthly principal and interest payments, but don’t account for things on like property tax and home insurance costs in these estimates.

Using a mortgage calculator is a smart way to estimate the true cost of your monthly mortgage so you can find the best house in a comfortable price range.

Now let’s break down how to use one to get the most accurate numbers.

How to Use a Mortgage Calculator

When using a mortgage calculator for a straightforward home purchase (rather than a refinance), you’ll need a few key pieces of information.

Home Price: This is the price of the home, before you pay your down payment

Down Payment: You can either put in a dollar amount or a percentage of the home price. If you have a set amount of money saved to use as your down payment, use the dollar amount. If you want to pay a 10% down payment regardless of price, choose that route.

Length of Loan: A 30 year mortgage is the most common, although most lenders also offer 10, 15, and 20 year loans.

Interest Rate: This depends largely on your credit score (and other factors). For an accurate number based on your specific score and loan type, talk to a lender. Otherwise, search for today’s average interest rate to get a general idea of what to expect.

Once you input all of your data, you’ll receive a monthly payment amount for your principal and interest.

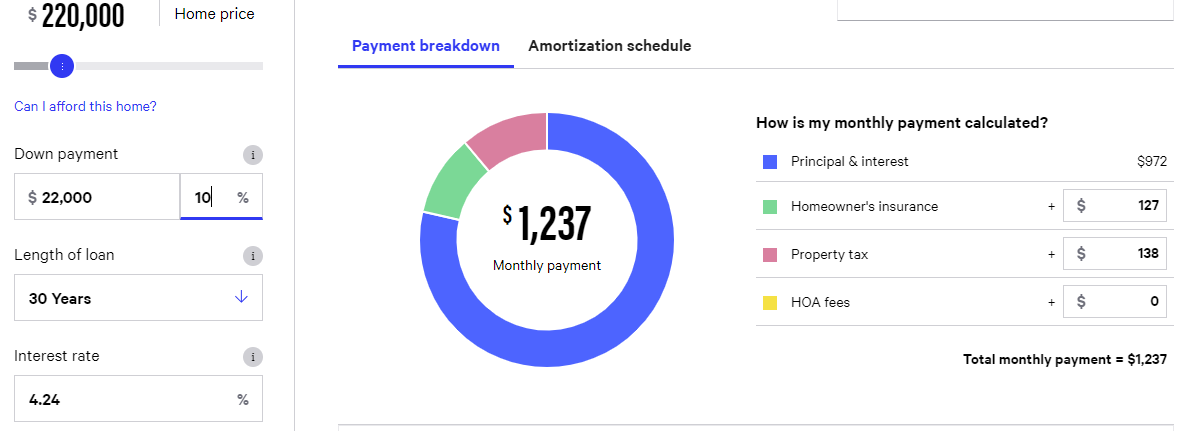

Here’s an example of how it looks using a basic mortgage calculator from BankRate.

Notice that in addition to details around your home loan, you can also input monthly amounts for your homeowner’s insurance, property tax, and homeowners association (HOA) fees. Together, that helps you determine what you’ll actually spend on your mortgage each month.

One other important fee you may need to take into consideration is private mortgage insurance (PMI).

Most home loans charge PMI if you make less than a 20% down payment. The amount you’ll pay depends primarily on the type of mortgage you choose. Expect to pay as much as 1% of your loan amount each year, which is then divided up and added to your 12 monthly payments.

Final Thoughts

Make a mortgage calculator your friend throughout the home buying process. Use it early on to play around with different home prices and down payment amounts to give you a good idea of what price range you should be looking at.

Once you get an offer accepted on a home, use a mortgage calculator again using numbers specific to that property. You can get a quote on homeowner’s insurance and find the annual property tax amount to incorporate into your calculations.

By keeping a constant pulse on your home loan financials, you’ll avoid unpleasant surprises on closing day, and instead confidently enjoy your new journey as a homeowner.